child tax credit 2021 income limit

On July 15 2021 certain taxpayers will begin receiving the first. These people are eligible for the full 2021 Child Tax Credit for each qualifying child.

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Up to 8000 for two or more qualifying people who.

. 150000 if you are. Families that do not qualify for the credit using the revised income limits are. Discover Helpful Information And Resources On Taxes From AARP.

Child Care Tax Credit Limit Podemosenmovimiento 2022 from wwwpodemosenmovimientoinfo. To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and. Step 1 phaseout.

150000 if you are. The credit begins to. Ad Get the most out of your income tax refund.

150000 if married and. The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021 exceeds. Married couples filing a joint return with income of 150000 or less.

The credit amounts will increase for many. The advance is 50 of your child tax credit with the rest claimed on next years return. Businesses and Self Employed.

The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021 exceeds. However the IRS estimates that about 15 of eligible individuals do not claim this tax. Here is some important information to understand about this years Child Tax Credit.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Child dependents who are 17 years. What is the income limit for the child tax credit 2021.

Child Tax Credit. To qualify and claim the Child Tax Credit taxpayers must have an adjusted gross income of less than 75000 for single filers or 110000 for joint filers. Without further extensions the Child Tax Credit CTC will return to normal levels in 2022 and can be claimed when filing your tax return next year.

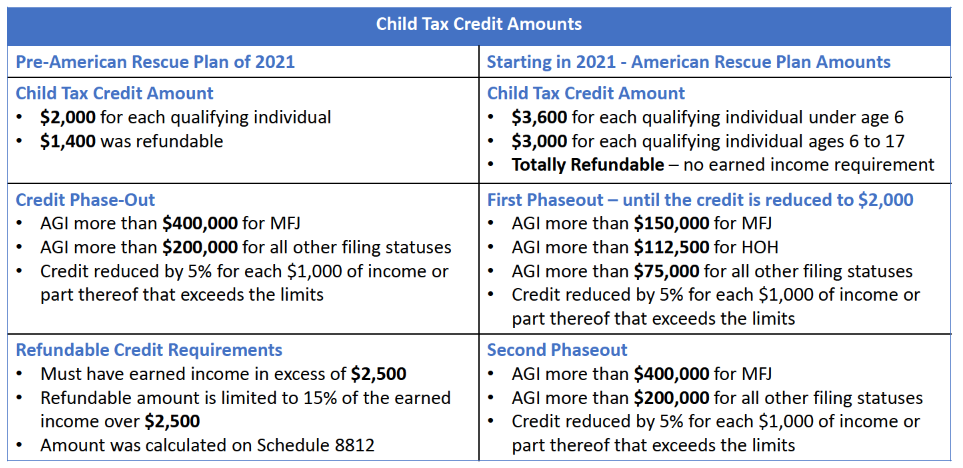

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. 425 38 votes. 3000 for children ages.

Line 21400 was line 214 before tax year 2019. 3600 for children ages 5 and under at the end of 2021. You do not need to have a child to be eligible to claim the Earned Income Tax Credit.

The first phaseout can reduce the CTC to 2000 per child. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The Child Tax Credit provides money to support American families.

Credit per dependent child ages 6-17. The second phaseout can reduce the. The Child Tax Credit begins to be reduced to 2000 per child when the taxpayers modified adjusted gross income in 2021 exceeds.

Families with a single parent also. The new Child Tax credit phases out with income in two different steps. The American Rescue Plan Act which was passed in March 2021 temporarily expanded and enhanced the Child Tax Credit.

Most workers can claim the Earned Income Tax Credit if your earned income is less than 21430. The Child Tax Credit changes for 2021 have lower income limits than the original Child Tax Credit. Credit per dependent child under 6.

The Child Tax Credit wont begin to be reduced below 2000 per child until your modified AGI in 2021 exceeds. Up to 4000 for one qualifying person for example a dependent who is under age 13 who needs care up from 1050 before 2021. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of.

The earned income tax credit is available to claim for the 2022 and 2023 tax seasons. Ad The new advance Child Tax Credit is based on your previously filed tax return. 455 55 votes.

The child tax credit CTC will. 2021 rules going away. Tips Services To Get More Back From Income Tax Credit.

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

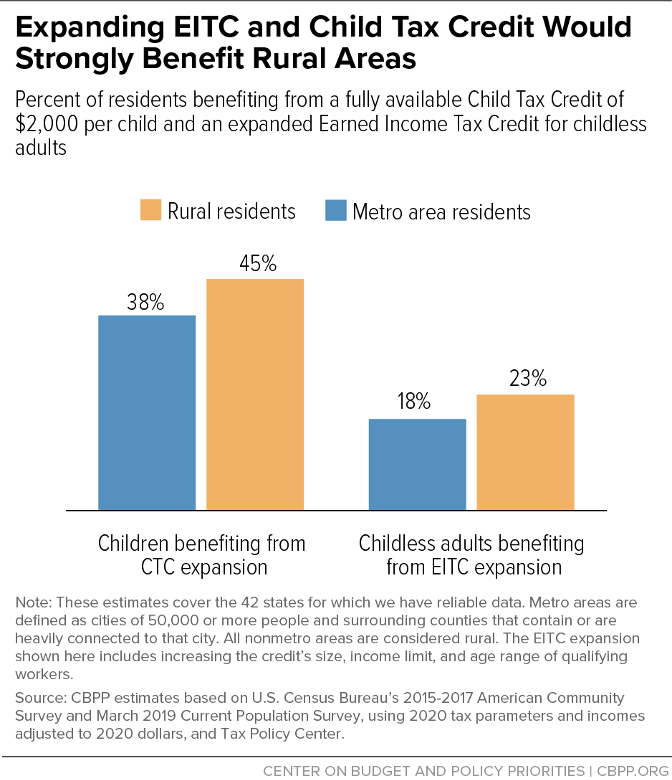

Tax Preparation And The Earned Income Tax Credit In Rural America Ncimpact Initiative

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

The Child Tax Credit Research Analysis Learn More About The Ctc

How To Get Up To 3 600 Child Income Tax Credit Now Michael Ryan Money

Child Tax Credit 2021 Changes Grass Roots Taxes

Publication 596 2021 Earned Income Credit Eic Internal Revenue Service

What Is The Child Tax Credit Tax Policy Center

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

2021 Changes To Child Tax Credit Support

2021 Advanced Child Tax Credit What It Means For Your Family

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

What Is The 2013 Child Tax Credit Additonal Child Tax Credit